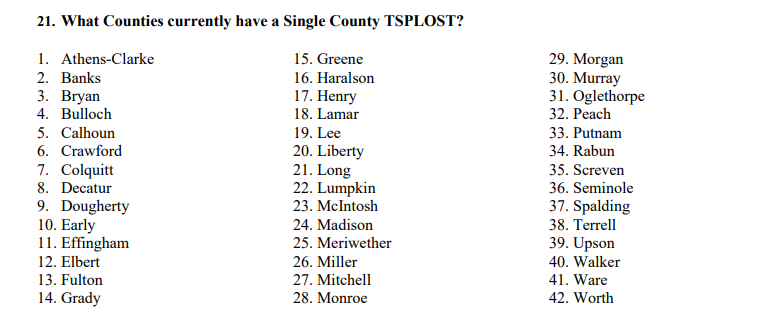

A Special Purpose Local Option Sales Tax (SPLOST) is a sales tax used to fund capital outlay projects proposed by the county government and municipal governments. A single county TSPLOST is a sales tax where the projects consist of transportation purposes only.

?

To qualify to hold a TSPLOST referendum, a county must already impose a regular SPLOST. State law imposes a 2% cap on local sales taxes. Most counties have several different 1% sales taxes (SPLOST, LOST, MARTA, etc.) Single county TSPLOST is in addition to these taxes. This tax will NOT affect any other local sales and use tax and is exempted from the 2% cap (See O.C.G.A. 48-8-6 (a).

?

The amount of money collected will depend on your county and your sales rate. Projections based on current SPLOST collections are a good starting point minus the exemptions listed below. There are six items that are exempt from taxation on the law. (See O.C.G.A 48-8-269)

*See: 2020 and 2021 County Motor Fuel Return Sales Per County

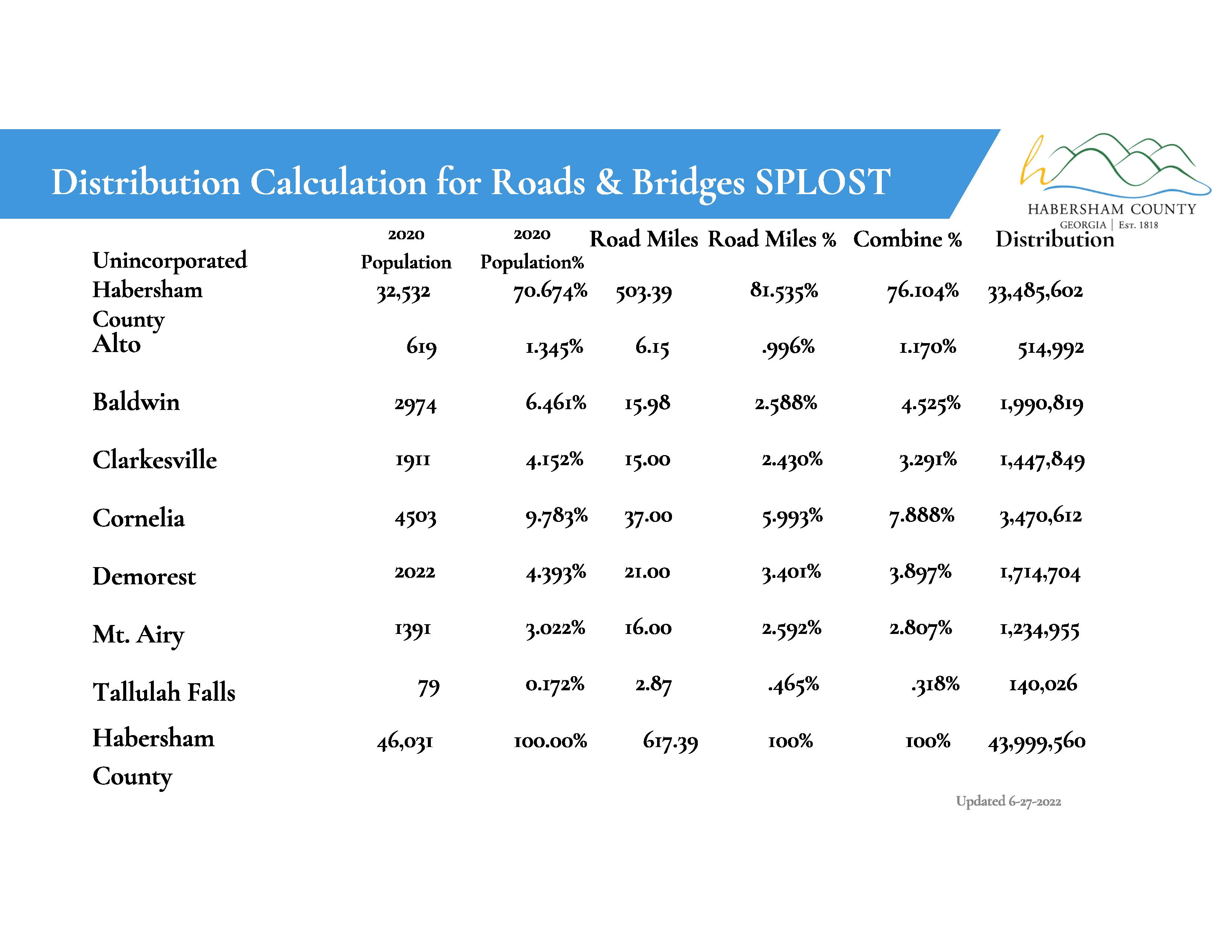

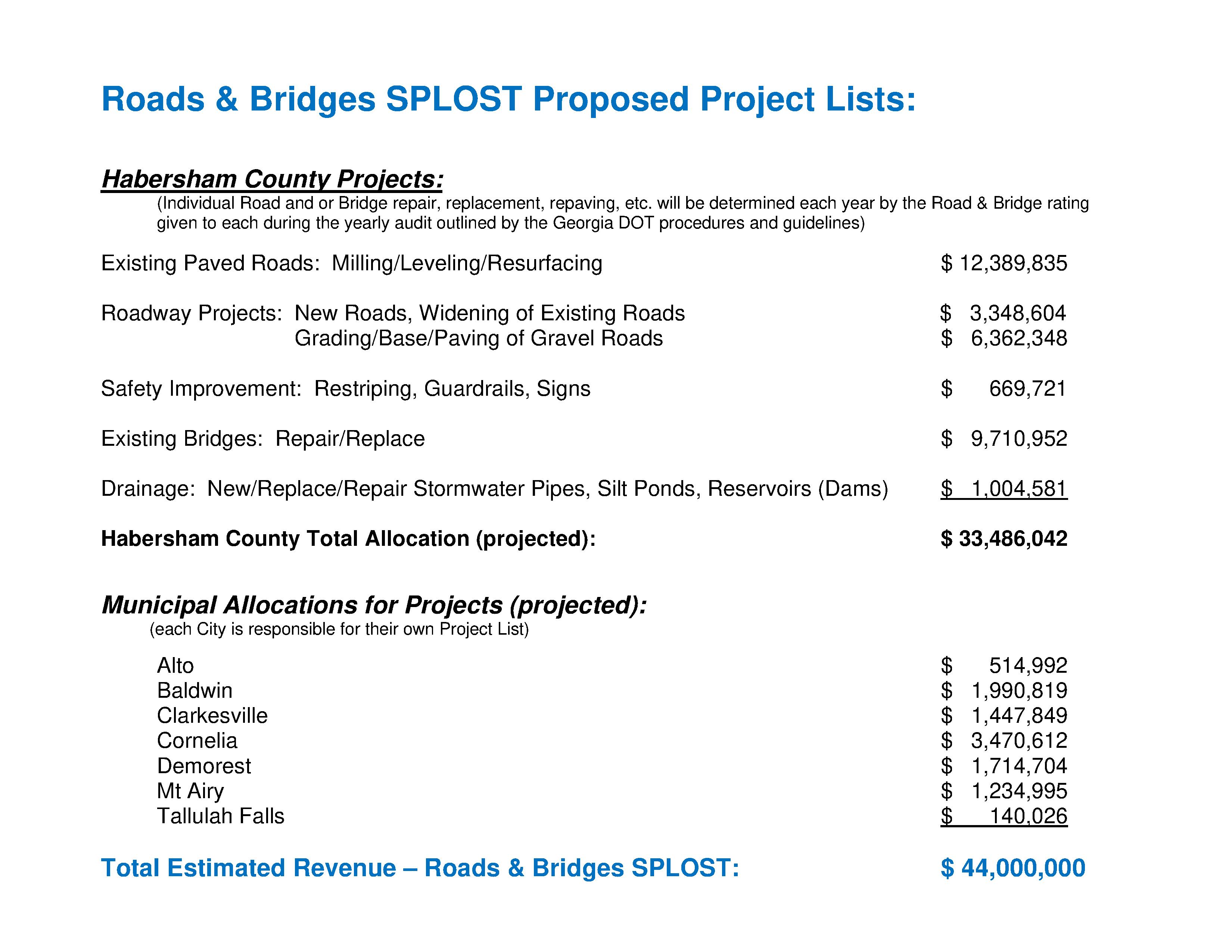

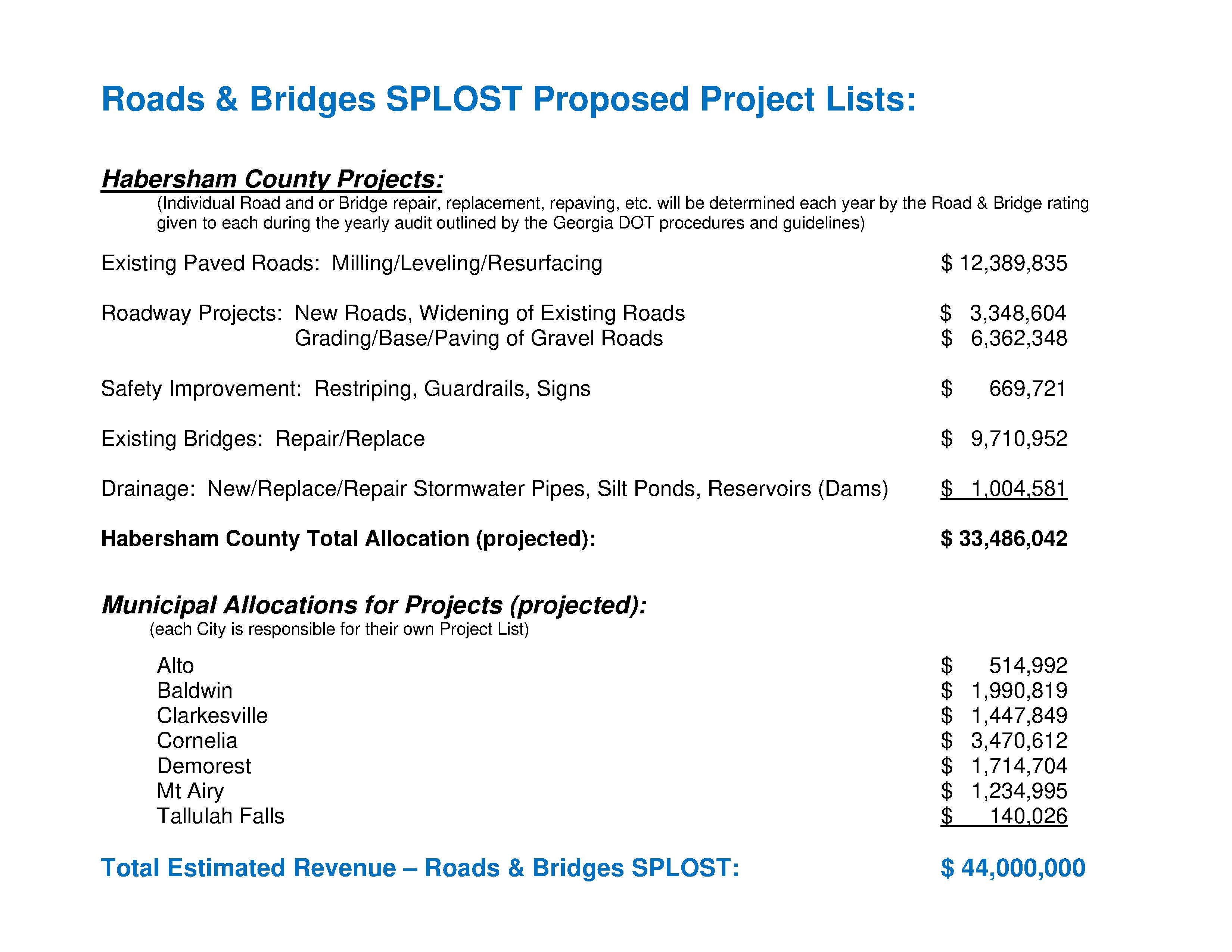

It is estimated that the total revenue that would be recieved from the passing of a Roads and Bridges SPLOST in Habersham County would be $44 million, with the counties portion being approximately $34.5 million.

There are six items that are exempt from taxation on the law. (See O.C.G.A 48-8-269) • The sale or use of any type of fuel used for off-road heavy-duty equipment, off-road farm or agricultural equipment, or locomotives;

• The sale or use of jet fuel to or by a qualifying airline at a qualifying airport;

• The sale or use of fuel that is used for propulsion of motor vehicles on the public highways*;

• The sale or use of energy used in the manufacturing or processing of tangible goods primarily for resale;

• The sale or use of motor fuel for public mass transit; or

• The purchase or lease of any motor vehicle

*See: 2020 and 2021 County Motor Fuel Return Sales Per County

Yes. Single county TSPLOST is specifically made applicable to sales of food and food items. (See O.C.G.A. 48-8-269(b)).

Funds can be spent on “transportation purposes”. TSPLOST defines this as follows (See O.C.G.A. 48-8- 260(5)).

(5) 'Transportation purposes' means and includes roads, bridges, public transit, rails, airports, buses, seaports, including without limitation road, street, and bridge purposes pursuant to paragraph (1) of subsection (b) of Code Section 48-8-121, and all accompanying infrastructure and services necessary to provide access to these transportation facilities, including new general obligation debt and other multiyear obligations issued to finance such purposes. Such purposes shall also include the retirement of previously incurred general obligation debt with respect only to such purposes, but only if an intergovernmental agreement has been entered into under this part.

The reference above to O.C.G.A. 48-8-121 is to a part of the SPLOST law which describes certain allowable transportation purposes.

Code Section 48-8-121:

(b)(1) If the resolution or ordinance calling for the imposition of the tax specified that the proceeds of the tax are to be used in whole or in part for capital outlay projects consisting of road, street, and bridge purposes, then authorized uses of the tax proceeds shall include:

(A) Acquisition of rights of way for roads, streets, bridges, sidewalks, and bicycle paths;

(B) Construction of roads, streets, bridges, sidewalks, and bicycle paths;

(C) Renovation and improvement of roads, streets, bridges, sidewalks, and bicycle paths, including resurfacing;

(D) Relocation of utilities for roads, streets, bridges, sidewalks, and bicycle paths;

(E) Improvement of surface-water drainage from roads, streets, bridges, sidewalks, and bicycle paths;

(F) Patching, leveling, milling, widening, shoulder preparation, culvert repair, and other repairs necessary for the preservation of roads, streets, bridges, sidewalks, and bicycle paths.

(2) Storm-water capital outlay projects and drainage capital outlay projects may be funded pursuant to subparagraph (a)(1)(D) of Code Section 48-8-111 or in conjunction with road, street, and bridge capital outlay projects.

The definition of transportation purposes does not directly address transit operations. However, the text “and services” is considered to allow some degree of transit operations. Note that a jurisdiction can also retire previously incurred general obligation debt with proceeds from the tax.

?

A minimum of 30% of revenue generated must be used on projects consistent with the Statewide Strategic Transportation Plan (SSTP). The SSTP is a policy document and does not include an exhaustive list of projects. The SSTP outlines a series of statewide priorities and identifies several programs and/or plans which directly support those priorities. A handful of key projects are identified in various places throughout the document to illustrate how a program or plan may ultimately result in implementation of a specific project.

Because the SSTP identifies a broad range of supportive strategies and programs, many projects will be consistent with the SSTP. For example, projects that would be considered consistent include interchange projects, safety projects, operational improvement projects, etc.

You can find the 2021 SSTP document here.

For any Single County T-SPLOST imposed under a resolution adopted prior to May 2, 2022*(See HB 934, Section 5), the tax can be levied up to five years at a fractional rate up to 1 percent in .05 percent increments if there is an intergovernmental agreement with the qualified cities within the county.

If there is no intergovernmental agreement in place, the tax can be levied up to five years at a fractional rate up to .75 percent.

The tax ceases to be imposed on the earliest of the following dates:

On the final day of the maximum period of time (5 years) OR the end of the calendar quarter that the state revenue commissioner determines that the tax will have raised revenues sufficient to provide funds specified as the maximum amount of funds to be raised by the tax.

It should be noted that projects do not have to be completed in the five-year window. However, it is prudent for public trust that projects move forward as rapidly as possible.

For any Single County T-SPLOST imposed or to be imposed under a resolution adopted on or after May 2, 2022* (See HB 934, Section 5):

Single County TSPLOST is now allowed to be collected for the full amount of time (five years), as opposed to ending once the estimated amount is collected.

In order to collect for the maximum amount of time, an intergovernmental agreement (IGA) would have to be in place between the county and cities and all proceeds would be spent according to the IGA - on transportation purposes. The HB 934 changes will not be retroactive but will apply to new TSPLOST referendums starting in November 2022. (See HB 934, Section 5 and O.C.G.A. 48-8-264.1).

*May 2, 2022 is the date the Governor signed HB 934; therefore is the effective date of this legislation.

?

Yes, the tax can be renewed following the same process. This process can occur while the current tax is still being collected.

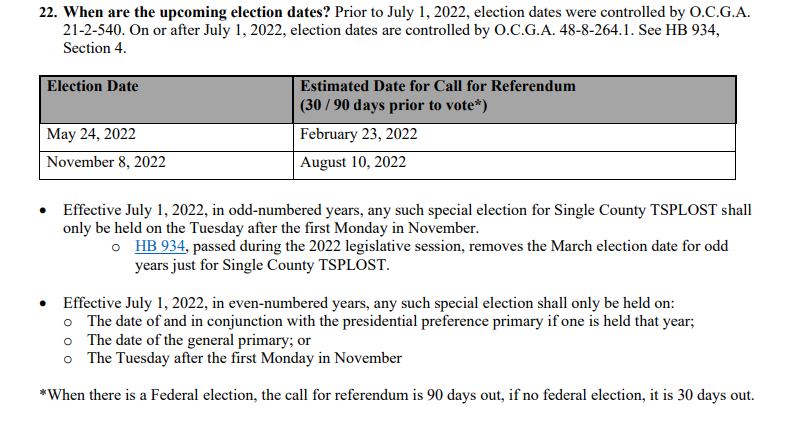

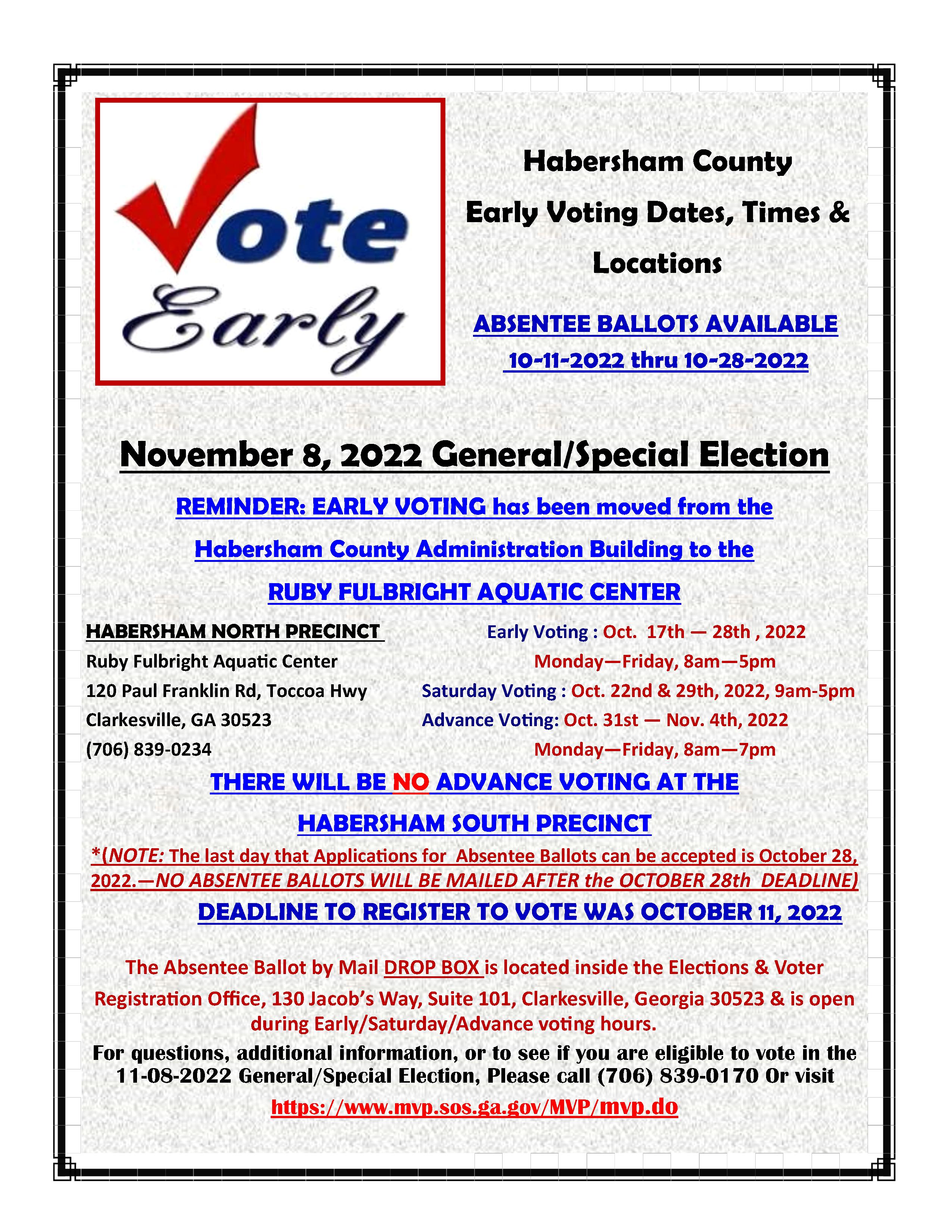

Collections begin on the first day of the calendar quarter following an 80 day period after the vote. The referendum must be conducted during the next scheduled election following agreement on the project list.

For example, if a successful referendum is held in November, the collections would begin on April 1 of the following year.

?

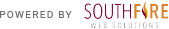

- The two primary funding sources for road maintenance/construction, bridge maintenance and stormwater infastructure are SPLOST & LMIG.

- The current six-year SPLOST includes and estimated $9.7 million allocated to road construction/maintenance, and bridge updates/repairs/replacement. This averages out to $1.6 million per year.

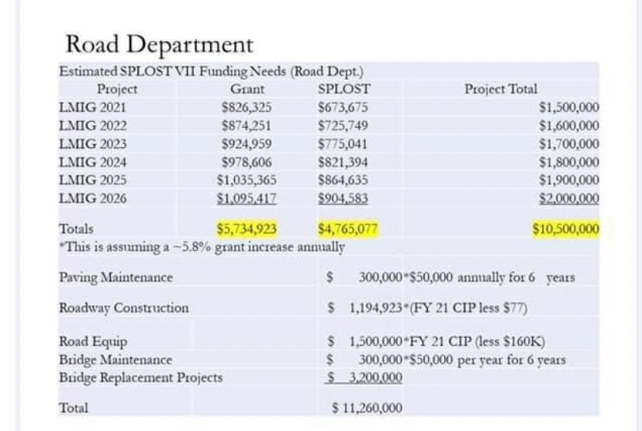

- The Cost per mile for road resurfacing has increased dramatically from 2021 to 2022.

No. The proceeds of this tax are not subject to any balancing formulas used by GDOT. Note that there is no reduction in LMIG Match (remains at 30%).

In order for the Tax Rate to be in excess of 0.75%, an Intergovernmental Agreement (IGA) must be executed among the County and Qualified Cities. If an IGA is entered, the tax rate can be up to 1%. The funds are then to be distributed in accordance with the executed Intergovernmental Agreement.

NOTE: With the approval of the Georgia Department of Revenue, the funds may be distributed directly to the cities and the unincorporated County, based on the terms of the IGA.

When there is no IGA the county can levy a fractional rate up to .75% and there is no 30% Statewide Strategic Transportation Plan (SSTP) requirement. The distribution formula between the county and its cities defaults to a formula based on the amount of expenditures made for transportation in the most recent 3 fiscal years. The proportional amount is determined by dividing the average expended in previous three fiscal years by the aggregate average expended on transportation by county and all qualified municipalities during the same time frame. Amounts include maintenance and operations. The distribution amounts shall be certified by the state auditor.

Click Here For IGA Between Habersham County and Muncipalities

A city is allowed to share in TSPLOST only if it is qualified. TSPLOST defines a qualified city in the same manner as SPLOST. (See O.C.G.A. 48-8-260(3)). In other words, a qualified city means only those incorporated cities which provide at least three of the following services, either directly or by contract:

(A) Law enforcement;

(B) Fire protection (which may be furnished by a volunteer fire force) and fire safety;

(C) Road and street construction or maintenance;

(D) Solid waste management;

(E) Water supply or distribution or both;

(F) Waste-water treatment;

(G) Storm-water collection and disposal;

(H) Electric or gas utility services;

(I) Enforcement of building, housing, plumbing, and electrical codes and other similar codes;

(J) Planning and zoning;

(K) Recreational facilities; or

(L) Library.

?

Although there are no criteria specified in the Code, it is recommended that there be a high level of coordination among the jurisdictions to assure adherence to local, regional, and statewide plans; consistency of corridors; connectivity; etc.

No. The law allows flexibility in project selection. The cities and the unincorporated county have a broad range of transportation projects and programs to choose from in identifying projects and purposes.

?The Code sets minimum requirements for provisions that must be included in an IGA:

(2) If an intergovernmental agreement authorized by paragraph (1) of this subsection is entered into, it shall, at a minimum, include the following:

(A) A list of the projects and purposes qualifying as transportation purposes proposed to be funded from the tax, including an expenditure of at least 30 percent of the estimated revenue from the tax on projects consistent with the state-wide strategic transportation plan as defined in paragraph (6) of subsection (a) of Code Section 32-2-22;

(B) The estimated or projected dollar amounts allocated for each transportation purpose from proceeds from the tax;

(C) The procedures for distributing proceeds from the tax to qualified municipalities;

(D) A schedule for distributing proceeds from the tax to qualified municipalities which shall include the priority or order in which transportation purposes will be fully or partially funded; Page 6

(E) A provision that all transportation purposes included in the agreement shall be funded from proceeds from the tax except as otherwise agreed;

(F) A provision that proceeds from the tax shall be maintained in separate accounts and utilized exclusively for the specified purposes;

(G) Record-keeping and audit procedures necessary to carry out the purposes of this article; and

(H) Such other provisions as the county and qualified municipalities choose to address.

?

Nearly all of funds will go to projects, including funds for Project Engineering and acquisition of Rights of Way. However, there could be money set aside for program management. Program management costs typically are in the range of 3-5%.

NOTE: The law does require that 1% is retained by the state revenue commissioner to be paid to the general fund of the state treasury in order to defray the cost of administration.

?

General Obligation Debt Financing: To utilize general obligation (GO) debt financing, the local government must be specifically authorized by the voters, through the TSPLOST referendum, to issue GO debt.

Lease-Purchase Transactions (example: leasing of road equipment)

Georgia Transportation Infrastructure Bank (GTIB): A low interest loan and grant program for CID’s, state, regional, and local government entities that is managed by the State Road and Tollway Authority.

?

A formal meeting must be called by the county to discuss possible projects to be included in the referendum and the rate of tax. The law requires that the formal meeting must be held at least 30 days prior to the calling of a referendum.

Meeting notice has to be hand delivered or mailed at least ten days prior to the date of the meeting to each qualified city. The meeting notice must includes the date, time, place and purpose of the meeting.

Following the meeting, the county and the qualified cities could enter into an IGA.

As soon as practicable after the meeting between the county and qualified cities and the execution of an IGA, the county shall by a majority vote on a resolution calling for the Single County TSPLOST referendum.

The resolution for the call for the referendum must then be submitted to the County Election Superintendent and include the following:

• Specific transportation purposes to be funded

• The approximate cost of those purposes and the amount of net proceeds expected to be raised

• The maximum amount of time in calendar years

?

“Shall a special ______ percent sales and use tax be imposed in the special district consisting of __________ County for a period not to exceed ________ and for the raising of not more than an estimated amount of $_________________ for transportation purposes?”

(NOTE: If debt is to be issued, the ballot must include the following wording, in addition to the above :)

“If imposition of the tax is approved by the voters, such vote shall also constitute approval of the issuance of general obligation debt of ___________ County in the principal amount of $__________________ for the above purpose.”

Translate Page

Translate Page